Page 1 of 1

Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Tue, 16 Jan 2018 10:21 am

by NR91

Hello,

I know this has been asked multiple times before but I am not getting a clear answer.

I recently moved from US to Singapore, holding an Indian passport and started working from Sep 11, 2017. Hence for CY17, I approx. worked for 111 days, however I would work for entire CY18 in Singapore.

When filling taxes, would I be a tax-resident and pay progressive taxes or would I be taxed at flat 15%?

Appreciate the support.

Thanks

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Tue, 16 Jan 2018 1:37 pm

by sundaymorningstaple

Is your work visa for 6, 12, or 24 months? If for 12 months or more, the odds are that you will be treated as a tax resident. At least that's the way it's been with my staffs who come during the 2nd half of the year.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Tue, 16 Jan 2018 4:50 pm

by NR91

sundaymorningstaple wrote:Is your work visa for 6, 12, or 24 months? If for 12 months or more, the odds are that you will be treated as a tax resident. At least that's the way it's been with my staffs who come during the 2nd half of the year.

My work visa is for 24 months. So if I understand your inputs correctly, I will be treated as tax resident.

Thanks for the inputs.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Tue, 16 Jan 2018 5:54 pm

by sundaymorningstaple

Please read my comments with accuracy.

"the odds are that you will be treated as a tax resident"

That does not mean it's a guaranteed thing. Just means that "in all probability" Anecdotal evidence is pretty good but again. It's not an exact science. Otherwise, yeah, you read my response fairly accurately.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Tue, 16 Jan 2018 11:47 pm

by Strong Eagle

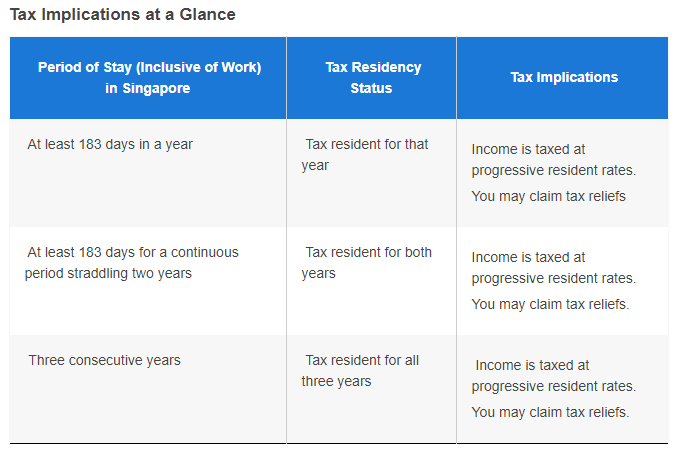

You'll be OK... your status is officially set at the time your tax is due, but it uses these guidelines.

See

https://www.iras.gov.sg/irashome/Indivi ... o-Pay-Tax/

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Wed, 17 Jan 2018 10:38 am

by NR91

sundaymorningstaple wrote:Please read my comments with accuracy.

"the odds are that you will be treated as a tax resident"

That does not mean it's a guaranteed thing. Just means that "in all probability" Anecdotal evidence is pretty good but again. It's not an exact science. Otherwise, yeah, you read my response fairly accurately.

Thank you for clarification. Prior joining (sometime in August, 17), my relocation adviser did mention that I will be progressively taxed but since he did not provide any additional information at that time, I raised this question here.

With your inputs, I am now clear why the relocating adviser mentioned that taxes will be progressive as I will be treated as tax resident owing to my work visa's validity for 24 months.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Wed, 17 Jan 2018 10:39 am

by NR91

Thanks for this. Now I'm clear with the entire methodology. Appreciate your response.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Wed, 17 Jan 2018 12:10 pm

by sundaymorningstaple

The IRAS website covers all scenarios except those who start work here after the 15th of November. These will not meet the 183 days by the final filing date of 15 April. But I do know of those who have been given resident rates even though they haven't met the 183 days spanning 2 years, hence my additional comment.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Wed, 17 Jan 2018 12:12 pm

by sundaymorningstaple

The IRAS website covers all scenarios except those who start work here after the 15th of November. These will not meet the 183 days by the final filing date of 15 April. But I do know of those who have been given resident rates even though they haven't met the 183 days spanning 2 years, hence my additional comment.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Wed, 17 Jan 2018 1:19 pm

by Strong Eagle

sundaymorningstaple wrote:The IRAS website covers all scenarios except those who start work here after the 15th of November. These will not meet the 183 days by the final filing date of 15 April. But I do know of those who have been given resident rates even though they haven't met the 183 days spanning 2 years, hence my additional comment.

SMS - I recall also (but can't find) posts in this forum where people who didn't meet 183 days in one year did pay the non-resident rate, only to have it adjusted in the following year. I believe the IRAS website says pretty much the same thing.

So, OP should be prepared for a non-resident assessment and tax payment, to be adjusted in the following year.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Wed, 17 Jan 2018 11:12 pm

by sundaymorningstaple

Which is the reason why I put

"the odds are that you will be treated as a tax resident" in my earlier post. I've had them given Resident rates if they are on at least a 12 month EP. It also might depend on the salary of the individual as well.

Re: Tax Residency Status - 111 Days in CY17 (365 in CY18)

Posted: Mon, 12 Feb 2018 11:37 am

by samuraibeefburger

Hi everyone,

I recently received an email from a bank requesting for information on my tax residency. My situation: I am Malaysian. I moved to Singapore in Aug 2016 and have been working here since (I have no other sources of income in Malaysia). So that would make me a tax resident of Singapore and Singapore only, right?

I'm pretty new to all of this, so please be kind. Appreciate your advice, thanks!